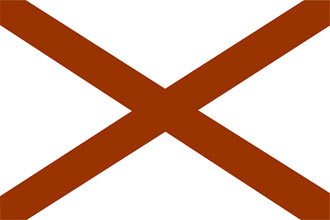

Alabama wage garnishment law generally aligns with the well-established federal laws on the subject, but with several important differences for low income workers. This difference was spawned by an Alabama appellate court decision extending protection to workers who are struggling to make ends meet. To best understand these and other protections offered by Alabama to its debtors, let’s first delve into some of the general principles governing Alabama garnishment laws.

Wage Garnishment is a Form of Attachment

Unlike some states, the concept of “garnishment” has no unique character in Alabama. A garnishment of wages is simply the attachment or sequestering of a debtor’s wages before the wages are paid out. A worker will still get her paycheck, but only for the amount that was not garnished. The garnished part is attached and paid directly by the employer to the creditor.

Wage Garnishment Orders Only Affect Employees

Today, more Alabamians than ever before work as freelancers or independent contractors. Luckily for them, their earnings can be garnished only when they are working strictly in the capacity of an ongoing employee. Income earned as a freelancer or independent contractor does not, in the world of wage garnishment, qualify as garnishable wages. A wage garnishment order serviced on a freelancer’s contracting client will thus be returned unsatisfied.

What Leads to a Wage Garnishment Order?

It always starts with a debt of some kind – credit card, student loan, automobile loan, payday loan, unpaid taxes, delinquent or unpaid child or spousal support. This debt goes unpaid by the debtor until the creditor gives up on the informal debt collection process and files a civil lawsuit for the entire amount of the unpaid debt, plus interest and penalties. At that time, the debtor should instantly look at her options.

Options to Alabama Debtors

The first thing a debtor should do is examine the paperwork to see if the debt is owed, whether the amount is correct, and whether the claim is time-barred. In Alabama, there is a short three-year statue-of-limitations on credit-card debts and six years for actions on written contracts. The legal rate of interest is six percent per annum, but contracts can allow higher rates if not usurious. With this in mind, the first option is trying to work out a settlement with the creditor. Failing that, the complaint should be answered and any affirmative defenses raised to the debt being owed. If the creditor gets a money judgement and applies for a wage garnishment order, now is the time for the debtor to assert federal and state exemptions and protections to curb an overly-aggressive creditor.

The first thing a debtor should do is examine the paperwork to see if the debt is owed, whether the amount is correct, and whether the claim is time-barred. In Alabama, there is a short three-year statue-of-limitations on credit-card debts and six years for actions on written contracts. The legal rate of interest is six percent per annum, but contracts can allow higher rates if not usurious. With this in mind, the first option is trying to work out a settlement with the creditor. Failing that, the complaint should be answered and any affirmative defenses raised to the debt being owed. If the creditor gets a money judgement and applies for a wage garnishment order, now is the time for the debtor to assert federal and state exemptions and protections to curb an overly-aggressive creditor.

Wage Garnishment without Protections

Without statutory protections, debtors theoretically could watch their entire wages be garnished for the payment of delinquent debts. This would render many debtors incapable of meeting basic living expense for themselves and their families, possibly putting them into the streets or worse. In turn, the government would be saddled with the burden of both managing and providing for their welfare. To prevent this from happening, the federal government has passed a number of laws that limit how much an employee’s wages can be garnished at any one time. These limitations should be asserted at the first opportunity.

Federal Limitations on Wage Garnishment

Alabama debtors will find most of their wage garnishment protections set forth in federal law. The primary federal law in question is the Consumer Credit Protection Act, which provides that creditors can garnish wages only as permitted by the so-called “25-30 rule.” The 25% side of this rule allows creditors to garnish no more than 25% of a debtor-employee’s “disposable” wages. “Disposable” wages are those left after deduction for items like SSI, Disability, taxes, and certain pension and insurance premiums.

The other side of the rule serves as an alternative cap to the amount that can be garnished. It provides that 30 times the federal minimum wage cannot be garnished. It is a second safety net, if you will, and the one providing the greater protection will be the one that governs, overriding the other. Though states can adopt higher minimum wage amounts, which would necessarily increase the exempt portion of wages, Alabama has not chosen to do so. However, the appellate case referenced earlier does provide low income Alabamians greater protections than federal law.

Special Limits for Bankruptcy Debtors and IRS Tax Debts

Because bankruptcy law is also a creature of the federal government, it can override the federal protections extended to debtors by the Consumer Credit Protection Act. In both Chapter 7 straight bankruptcies and Chapter 13 reorganizations, the court can order as much as 90% of the employee’s disposable wages attached, though this rarely happens. The IRS can garnish as much as 70% of wages after applying a complicated IRS formula. In both situations, it is uncommon for garnishments to encroach on necessary living expenses or create an undue hardship.

Alabama’s Constitutional Cap on Wage Garnishment

As interpreted by the appellate court in Pruett Worldwide Asset Purchasing, section 204 of Article X of the Alabama Constitution, as amended in 1991, exempts from attachment the first $1000 of each and every paycheck. Before Pruett, the prevailing interpretation was that the Alabama Constitution only protected a sum total of $1000 of wages for the whole month. As long as the money is needed to pay living expenses, that figure is now $1,000 per paycheck. Consequently, Alabama debtors should be vigilant in raising this constitutional limitation in answer to any wage garnishment order issued against them.

Money Judgments Are Not Always Required

The typical route to for creditors to obtain a garnishment order is to first obtain a money judgement. Debts that typically travel this path are those arising from credit cards, uninsured medical expenses, utilities, retail installment debts, and the like. Certain creditors, however, need not jump through the hoop of filing a lawsuit. These creditors – the IRS, state tax authorities, spouses owed child support or alimony, and lenders of student loans, to list a few – can obtain their garnishment orders administratively. This enables them to garnish employee wages much more quickly.

Multiple Garnishment Orders

Alabama employers served with multiple garnishment orders for the same debtor-employee cannot pick and choose which ones to pay. Always subject to federal and Constitutional limits, employers must generally honor the following order of priority among debts:

- Delinquent child support and alimony or spousal support comes first,

- Federal, state, and local taxes next,

- Followed by defaulted student loans, and

- Lastly debts to private creditors (credit cards and the like).

Job Protection for Employees Whose Wages are Garnished

For smaller employers, the wage garnishment process is a hassle, and there was a time when many employers would prefer to fire the employee rather than deal with it. Under federal law, however, employers cannot take any punitive action against the employee as regards the first garnishment. Though federal law stops there, Alabama law further protects employees from being subject to adverse employment decisions (firing, etc.), regardless of the number of garnishments.

Conclusion

Depending on the circumstances, navigating the waters of debt collection and garnishment orders can become complicated and tricky. The right arguments must be made diligently and at the right time to maneuver through the details. If the amount owed is small, work out a deal, pay it off, and have it cleared from your credit report. If more is involved, consider hiring a qualified debt attorney or professional to help resolve the debt and provide you peace of mind.

References:

Garnishment, Alabama Code, Title 6, Civil Practices, § 6-6-430

Liens, 2009 Alabama Code, Title 35, § 30-11-1 et seq.

Alabama Telco Credit Union v. Gibbons, No. 2140604, 2015 WL 6618785 (Ala. Civ. App. October 30, 2015).

Pruett v. Worldwide Asset Purchasing, LLC, 140 So. 3d 481 (Ala. Civ. App. 2013).

Ala. Const. 1901, Art. X, § 204.

Federal Law

Public Law 99-150, enacted on November 13, 1985, amending the Fair Labor Standards Act

Title II of the Consumer Credit Protection Act, 15 U.S.C. Section 1671 to 1777 – applies to all garnishment orders

https://www.dol.gov/whd/regs/statutes/garn01.pdf

https://www.dol.gov/whd/garnishment/

https://www.dol.gov/whd/minimumwage.htm

Secondary Online Resources

Garnishment Protections, low income, https://www.alabamanews.net/2017/05/16/low-income-alabamians-protected-wage-garnishments/

Wage and Hour Info, https://labor.alabama.gov/Wage_and_Hour_Info.pdf

Payday laws, Alabama, https://www.minimum-wage.org/alabama/payday-frequency-laws